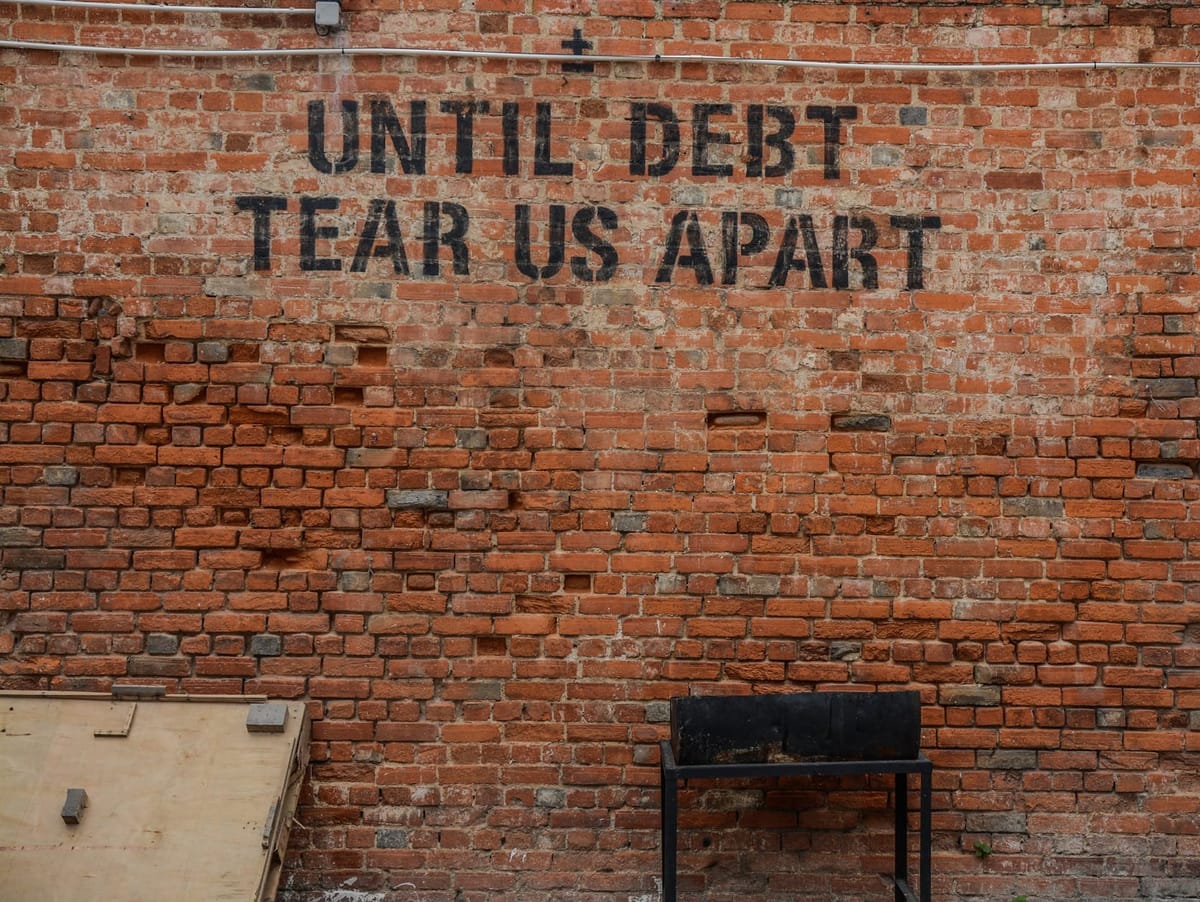

Crush Your Credit Card Debt - How you can use interest arbitrage to pay off debt faster

Credit card debt has reached record levels in the US, with the average household owing close to $10,000. Even worse — interest rates have spiked, making this debt much more expensive to carry. Keeping up with minimum payments while average credit card interest rate stands at 20.92% can seem impossible. Almost half of credit card holders (46%) carry debt from month to month, according to a recent survey. And this number is still pretty high at 37% when you zoom in on six-figure earners who make at least $100,000.

The True Cost of Credit Card Debt

Credit card debt feels easy to take on, but hard to pay off. When you only make minimum payments, the interest costs can quickly snowball. For example, if you owe $10,000 at 21% APR and only pay $200 per month, it will take over 10 years to pay off the balance! You’ll end up paying $13,972 in interest.

This debt trap impacts millions of Americans. Credit card companies rely on you NOT being able to pay off the balance. But what if you could tap affordable funds to pay it off faster?

Use Interest Arbitrage to Pay Off Debt

Interest arbitrage means borrowing money at a lower interest rate to pay off debt with a higher rate. This minimizes the total interest paid.

This is where Pull comes in…

The Smarter Way to Pay Off Debt

Pull allows you to tap your future earnings today in order to pay off high interest debt fast. There are no hidden fees or gotchas.

For example, let’s say you pull forward 50% of your salary for the next 3 months to pay off the credit card charging 21% APR. You pay a one-time upfront fee of 3–5% and save on all the interest by paying off the outstanding balance. Over time, these savings really add up.

You can use the funds to pay off credit cards, eliminating the need to keep paying painful interest charges every month. This interest arbitrage lets you pay off debt faster and cheaper.

No credit checks. No negative impact on your credit history. Because Pull taps into your payroll, there is no lengthy approval process. You get a real-time decision and get the funds in your bank account as quickly as the next day.

Repayment happens seamlessly through small deductions from each paycheck. There’s no risk of missing payments or additional debt piling up.

Take control of your financial future. Crush credit card debt for good with an affordable salary advance from Pull.

Sign up now for a Pull salary advance at www.pullnow.com